The State of Commerce Experience 2021

An annual study on the latest digital commerce trends and global consumer shifts

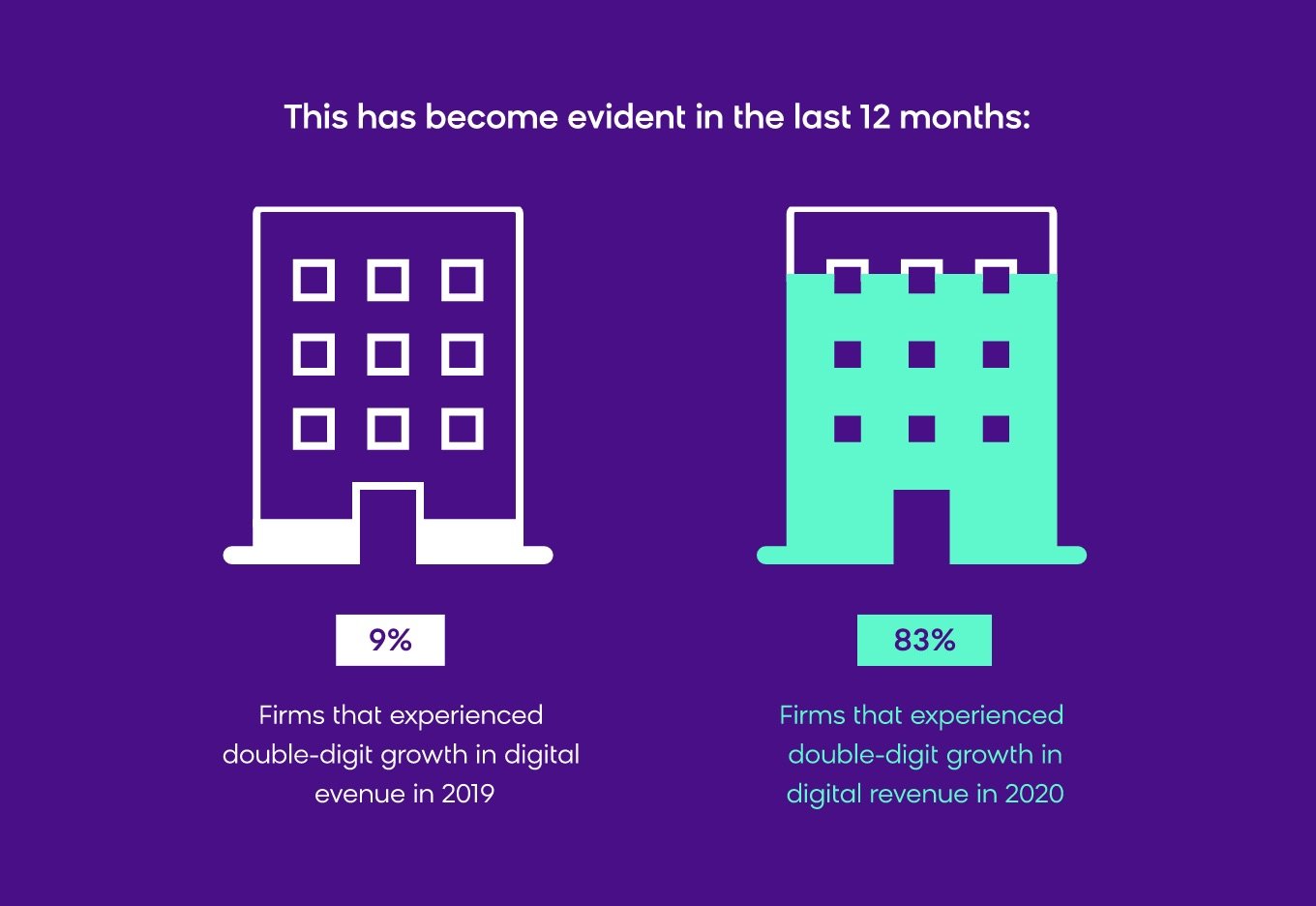

In 2020, a whopping 83% of decision-makers reported double-digit growth in digital revenue. In 2019, before COVID-19, only 9% experienced such growth. This is not a moment to let pass you by.

Bloomreach, the leader in commerce experience ™, commissioned Forrester to conduct an online survey of B2B and B2C decision-makers in e-commerce.

Read on to discover what the study found, and how firms can capitalize on the market share they’ve captured during COVID-19.

In a hurry?

Download a PDF version for easier offline reading and sharing with coworkers.

How Did We Get Here?

COVID-19 incited a major turning point in e-commerce history. With brick-and-mortar shops closed for much of 2020, B2C consumers and B2B customers relied on digital channels to make purchases. This shift certainly amplified online behaviors, but more importantly, it created new ones, as many buyers shopped online for products they’d never bought online before.

Our Online Lives After Pandemic

Buyers Prefer to Research and Purchase Online

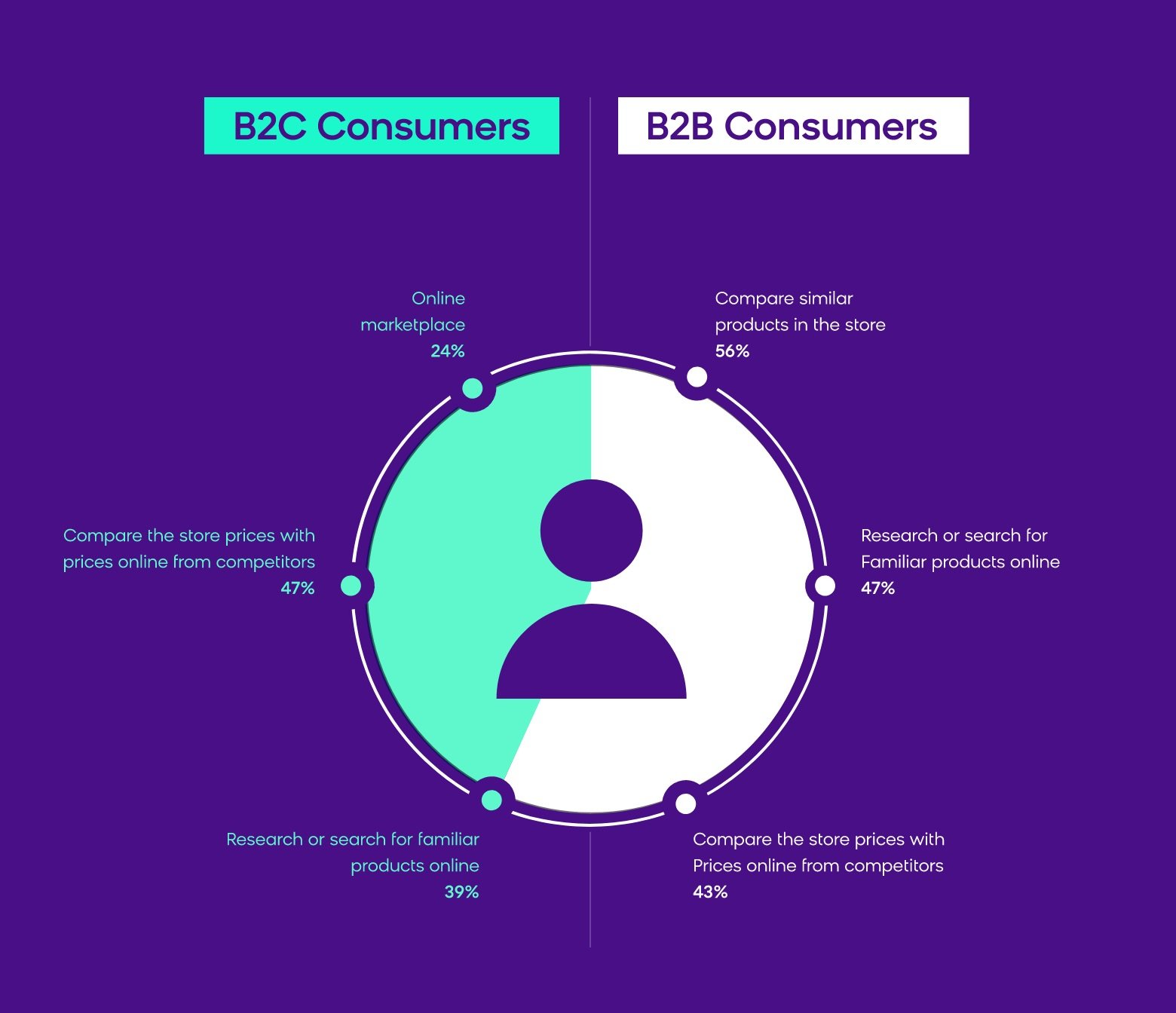

Prior to the pandemic, it was common for consumers to do online research about purchases they planned to make -- even when the intent was to make the purchase in-store. Since COVID-19, these behaviors have amplified, and now include products consumers have never purchased online before in both the B2C and B2B spaces.

Online Activity Also Influences

In-Store Expectations

Almost half (44%) of B2C buyers and 58% of B2B buyers say they always or often research a product online before going to a physical store. Even when in-store, they will still go online to continue their research:

Direct Website is Playing a

Key Role in The Buyer Journey

and Business Growth

Key Reasons:

It’s growing faster

It’s contributing more revenue

It has a higher sales volume

The Most Commonly Missed Opportunity

Buyers Have Disappointing Experiences

Only about a third of buyers are completely satisfied with their research experience or purchase experience on direct websites.

Higher than expected product prices

Difficulty finding answers to questions

Inability to find products they were looking for

What Customers Want (Expectation) Vs. What Businesses Are Missing (Reality)

EXPECTATION

Buyers want easy navigation, relevant search, and the ability to refine results.

- 2 out of 3 don’t provide autofill search.

- Even though most businesses think they provide easy navigation and search, buyers list them as their top issues.

EXPECTATION

Most customers value ratings and reviews for supporting tools.

EXPECTATION

Buyers want product images, clear pricing, detailed product information, and product availability.

Technology Is The Biggest

Hurdle For Businesses

Across the e-commerce journey, technological obstacles prevent them from:

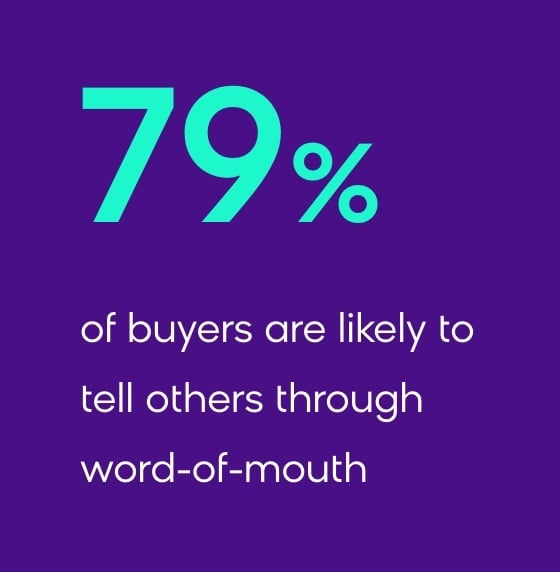

The Results of a Poor Experience

Making the Commitment to Digital

A tough time with technology thankfully hasn’t deterred commerce professionals. Customer experience (CX) is at the top of the firms' lists of priorities going forward. Most firms are expanding or planning to invest across digital commerce technologies and channels.

Firms believe the most important capabilities to deliver on their desired business outcomes are:

Marketing automation

CMS

CDP

Personalization

Recommended Next Steps

1. Fix the basics.

Commerce should start by fixing the basics. Conduct an audit of features and functionality that customers expect, and ensure that the features most used by your customers are in place. Design thinking workshops or website reviews are the second step to ensuring that those features are well-executed and not leaving money on the metaphorical table.

2. Build out a comprehensive to-do list.

Focus on all the top features and functions, which tend to be similar regardless of the type of business you are (e.g., B2B or B2C). All customers have high standards for easy digital experiences. Even less mature e-commerce sectors have customers who have been trained by more sophisticated players. The best players with the most feature-rich websites will thrive while those without such websites will lag.

3. Invest in e-commerce technology, even if it means taking funds from other parts of the business.

As digital has only increased in importance following the pandemic, commerce companies must reallocate resources to e-commerce technology and headcount to support that technology. One of the lasting impacts of the pandemic has been the growth of e-commerce and the recognition that digital selling is here to stay for all categories. Firms are now held back by inadequate technology budgets; as a result, firms must focus on solutions like site search, synchronization across touchpoints, and digital customer lifecycle management.

4. Reduce your variable costs where possible.

Investment in e-commerce technology isn’t enough. E-commerce tends to have higher variable costs, so it is also crucial to look to technology to reduce costs from returns and fulfillment expenses. Rich product content can often reduce returns, for instance, and investing in slower (but more transparent) shipping enables merchants to have their cake and eat it too.

5. Focus on owning your customers first and foremost.

The channel that commerce companies have seen grow the most throughout the pandemic has been their own. Brands and merchants must reduce their dependencies on the tech titans or other partners. Build your own customer database, leverage it for marketing, and promote your brand and direct-to-consumer business on your product packaging. Partners can be a customer acquisition strategy but are risky for retention or long-term demand generation.

How Bloomreach Can Help

Bloomreach is the leader in commerce experience™. Our flagship product, brX, is the only digital experience platform that utilizes the full spectrum of commerce data, from product to customer, alongside content management capabilities, and AI-driven search, merchandising, and personalization in one flexible, API-first platform.

We serve over 700 global brands including Albertsons, Staples, Bosch, Puma, FC Bayern München, and Marks & Spencer, and power $200 billion in digital commerce experiences annually.

Let's talk about your priorities and dig into your needs.

Download your copy